free cash flow yield screener

In early 2018 Hertz had a PE multiple of just 6 well below the SP 500 average of 22. Find The MT Bank Cash Management Solutions To Fit Your Financial Needs.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

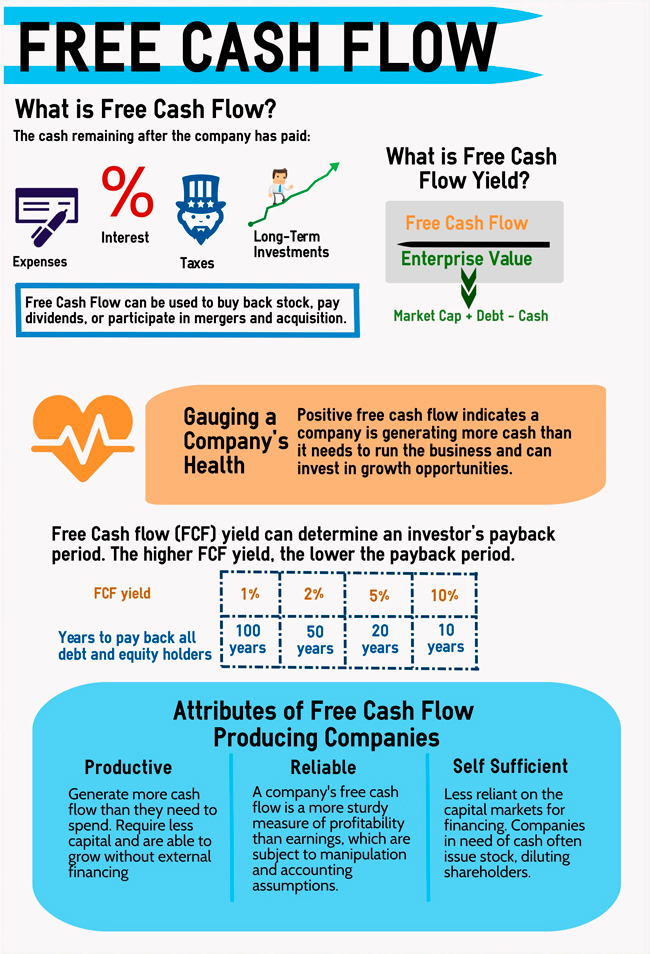

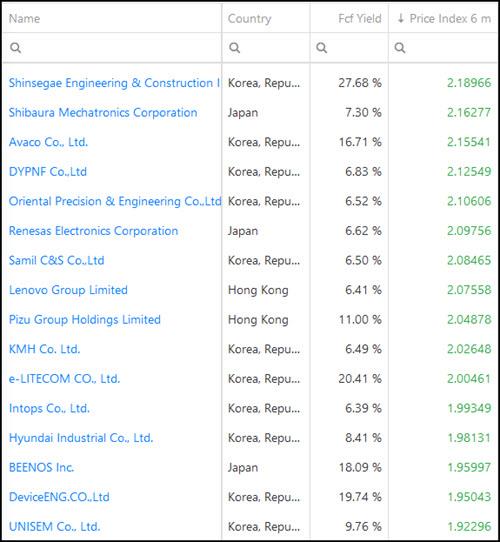

Free cash flow is defined as cash from operations - capital expenditure.

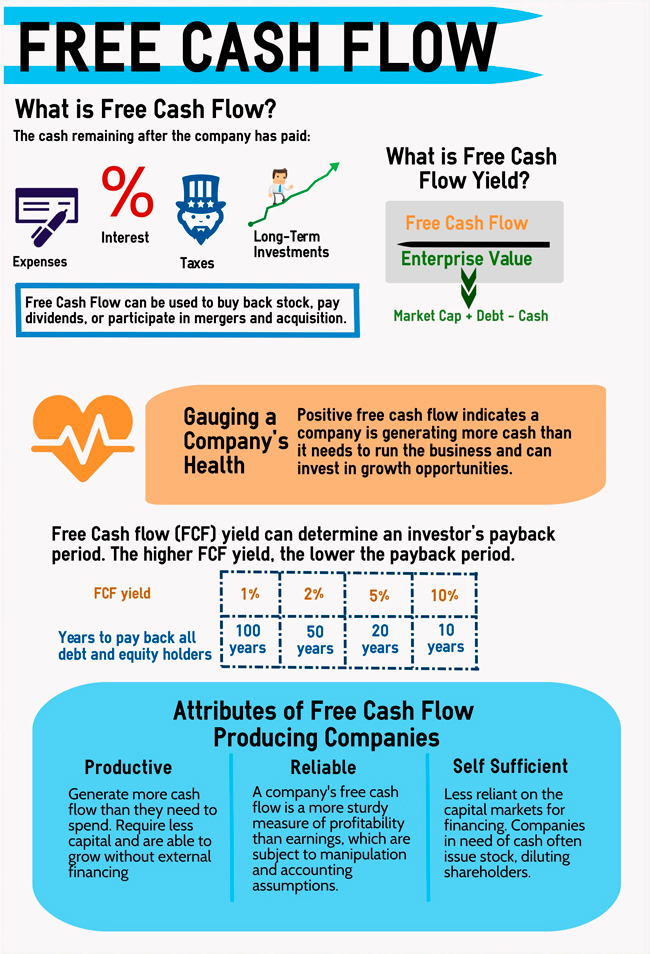

. Watchlists Ideas Screener Data Explorer Charts Saved Work. Total Cash from operations from the companys Cash Flow Statement Minus Capital Expenditure also from the Investing section of the Cash Flow Statement. 32 rows A stock screener that allows you to screen stocks based on Old School Value fundamentals valuation action score and thousands of other metrics.

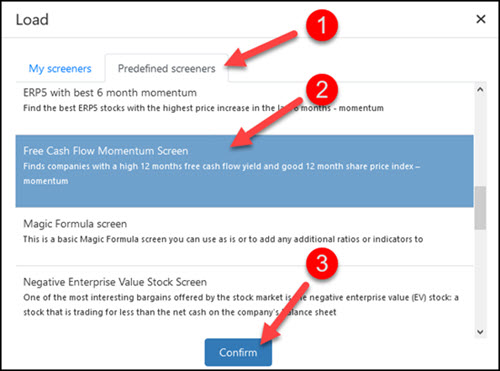

Free cash flow is the cash that a company is able to generate after paying off all of the bills maintaining existing asset bases and pursuing future growth. Based On Fundamental Analysis. Companies with Free cash flow yield more.

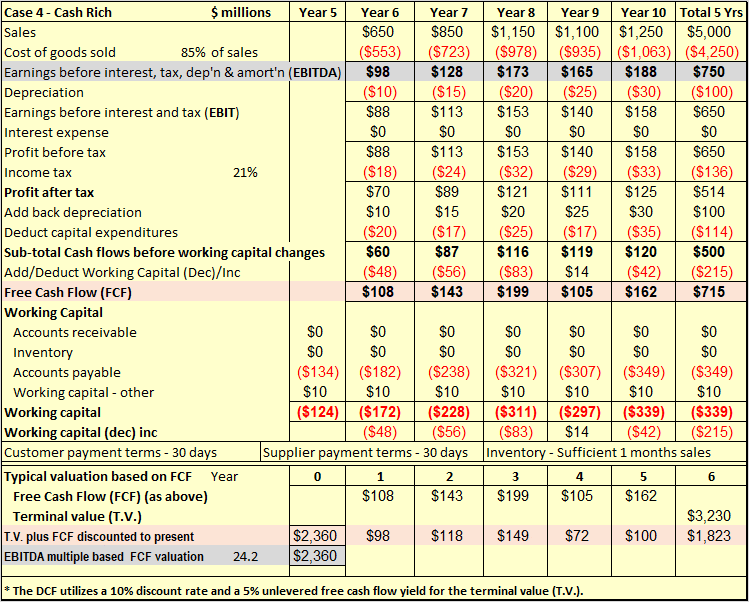

Ad Our Strong Buys Double the SP. In the Quant Investing stock screener we define Free Cash Flow FCF as. Then the free cash flow value is divided by the companys value or market cap.

Diversify your portfolio by investing in art real estate legal and more asset classes. Free Cash Flow Yield between 10 and 20. Our service Screenerco Stock Screener offers built in variables for Free Cash Flow EVFCF Price to Free Cash Flow Per Share and other variables that incorporate free cash flow.

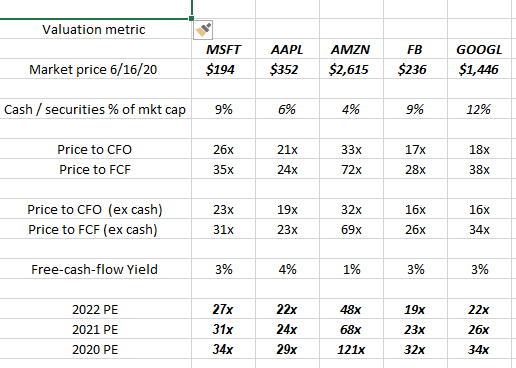

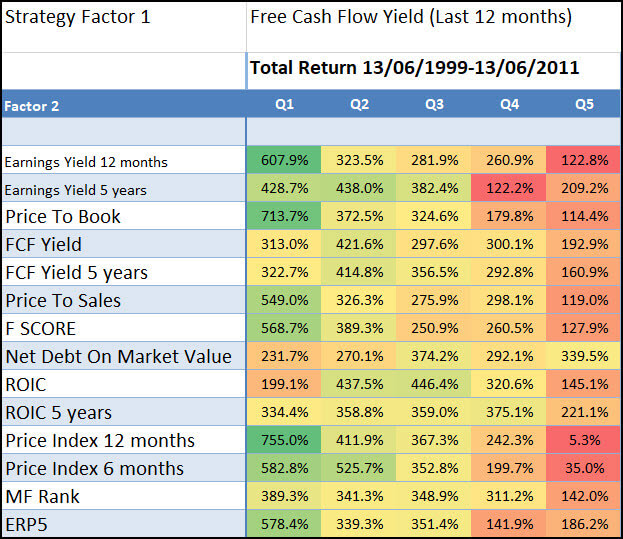

What works for achieving alpha Q1 Quintile 1 represents the cheapest 20 of companies in terms of five year average free cash. Ad Analyze up to 10 different valuation metrics like EPS EBITDA operating cash flow more. What is free cash flow and free cash flow yield Before we go any further lets make sure we know what we are talking about.

2 months 3 months 6 months 9 months 1 year 2 years 5 years 10 years Max. Price Free Cash Flow Ratio Stock Screener with an ability to backtest Price Free Cash Flow Ratio Stock Screening Strategy and setup trade alerts for Price Free Cash Flow Ratio signals. Understand the company youre investing in and know if a stock is over or under-valued.

SP500 03 DOW 03 FTSE 100 02 NIKKEI 02 OIL -09 GOLD -08. Quantitative Value Investing in Europe. Get the tools used by smart 2 investors.

27 rows stable free cash flow. Click image to enlarge. Excel-based Investment Research Solution for Serious.

The formula and methodology are described in What worked in the market from 1998-2008. Premade Screener Stocks With High Free Cash Flow Yield. Five year average FCF Current Enterprise Value.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Ad Over 2 Billion in Investments Funded To Date. News Fundamental Chart Financials and Stock.

Get updates by Email. Investors who wish to employ the best fundamental. You can also use our formulaic calculation engine to compute your own free cash flow metric using the Operating Cash Flow and Capital Expenditures variables.

Create Your Free Account Today. 21 rows Free Cash Flow Yield. Ad Customized Cash Flow Management Solutions From MT Bank.

Five year average free cash flow yield is defined as. - a free list of stocks with strong cash flow yield. Get updates by Email.

Free cash flow good roe roa low debt to equity. Daily chart sp 500 dividend and free cash flow yield index Duration. FCF yield is an accurate measure of future company and stock performance because it is derived from two calculated accurate values.

The ratio is calculated by taking the. We applied the discounted cash flow and discounted earnings to the high Predictability Rank and calculated the intrinsic values of the these companiesThese are the companies that appeared to be undervalued as measured by discounted free cash flow model or discounted earnings model. Showing page 1 of 3.

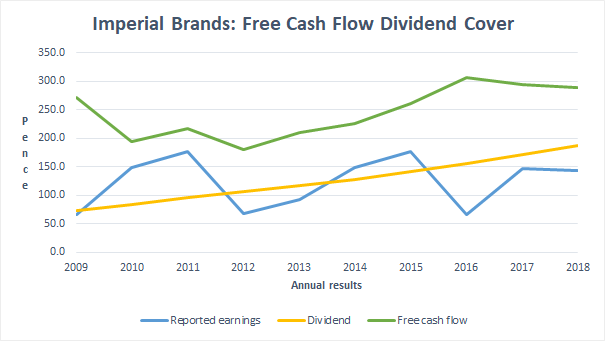

FCF is what enhances shareholder value and how dividends can be consistently paid. Take the case of Hertz HTZ. Free cash flow represents fund flows from operations in excess of capital expenditures and is used to determine the funding available for investing and financing activities including payment of dividends repayment of long-term debt reallocation to existing business units and deployment into new ventures.

Free cash flow yield is really just the companys free cash flow divided by its market value. With that said it is clear that a company able to increase and generate FCF will appreciate in value as. Every week we scan.

To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. Backtest your Price Free Cash Flow Ratio trading strategy before going live. Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio.

Free cash flow and enterprise value.

The Power Of Free Cash Flow Yield Pacer Etfs

The Power Of Free Cash Flow Yield Pacer Etfs

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Best Free Cash Flow Yield Stock Investment Ideas For 2021 Quant Investing

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Free Cash Flows Let S Have A Discussion Towards A Better Understanding Seeking Alpha

Fast Free Cash Flow Yield Screener For S Amp P 500 Stocks Using Marketxls Template Included

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Cash Flow Valuation Of Top 5 S P 500 Names Seeking Alpha

8 Value A Bond And Calculate Yield To Maturity Ytm Cash Flow Statement Value Investing Stock Screener

Free Cash Flow Yield Investment Strategy Quant Investing

Why Dividend Investors Should Look At Free Cash Flow Seeking Alpha

Guide To Stock Screener 1 Stock Screener Investment Tips Debt To Equity Ratio